Send us a message to learn about investment and borrowing opportunities by choosing a form or using the contact information below.

Investment Strategy

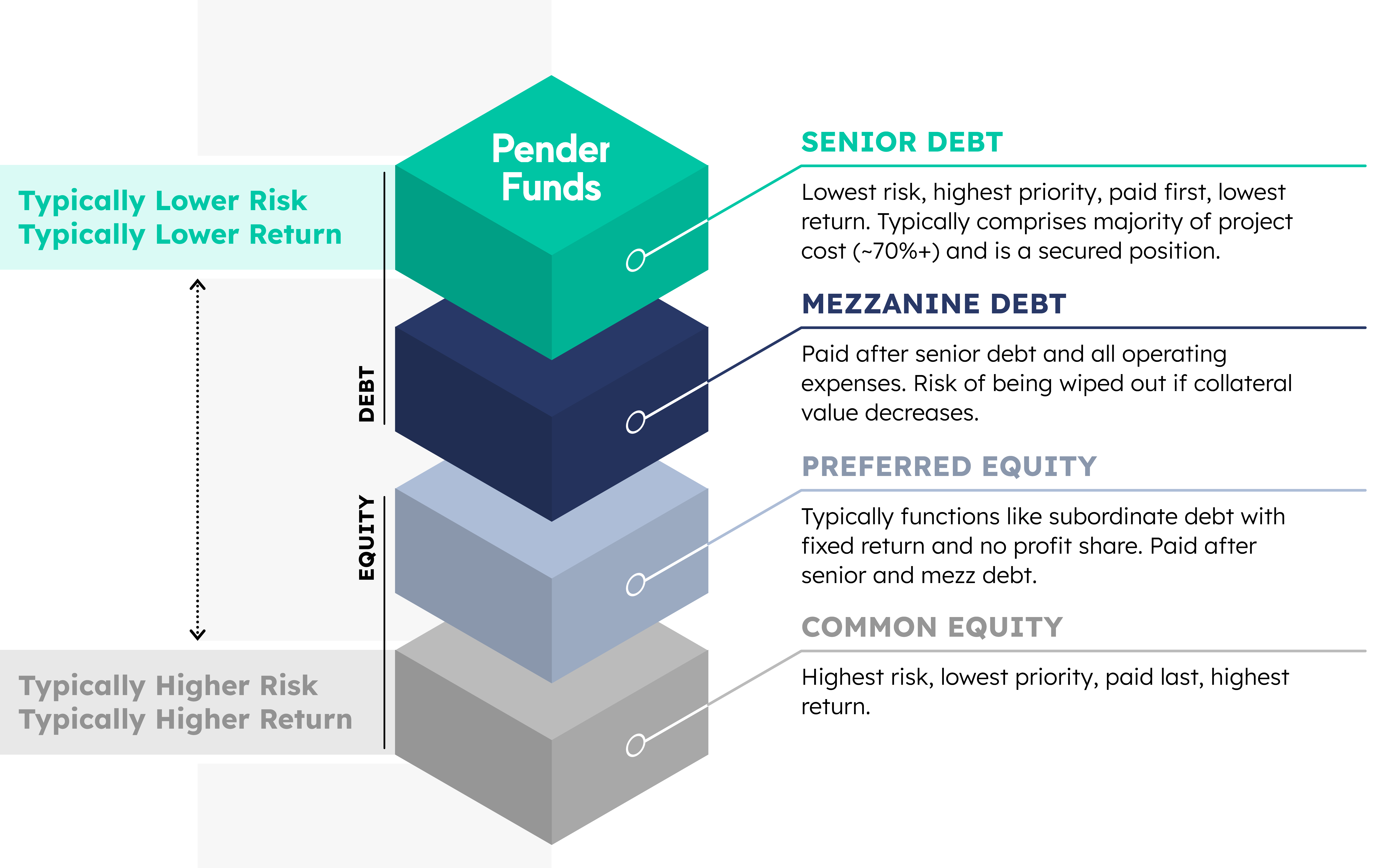

Capital Preservation First, Yield Generation Second

As leaders in private credit, Pender Capital sets the market standard in private lending by sourcing steady commercial real estate investments to build a balanced portfolio that minimizes risk and is managed with care and expertise for our investors.

We are primarily focused on capital preservation, so our assets construct a portfolio with that emphasis. To do so, our criteria maintains low LTVs and first-lien secured positions for a solid portfolio foundation. Using stringent underwriting metrics, we originate and service assets that are mostly:

- $10M-$30M target loan size.

- 12 to 36-month loans with optional extension

- Target LTV of 65%

- Primarily floating rate loans

- New originations and secondary market acquisitions

- First-position lien on primary collateral