Simply because real estate is regarded as a slow-moving asset, that doesn’t mean all pieces of a project align as intended or needed. With financing playing a critical role in purchasing, developing, holding, and exiting real property, alternative lending products have developed to meet these needs. Just as important as permanent and project financing, bridge loans have risen to address immediate funding needs during transitional periods.

These loans, sometimes referred to as “gap financing,” are designed to bridge the gap between the current financial situation and a more permanent, long-term financing solution. Typically, in the private debt context, they are particularly useful in scenarios where timing is crucial, and traditional loan processes are not available or too slow or cumbersome.

In the sections below, we cover the ins and outs of bridge loans, and how they are useful in the private lending world.

Key Characteristics

- Short-Term Duration: Bridge loans are inherently short-term, typically ranging from six months to three years. This short-term nature makes them ideal for situations requiring quick capital, such as acquiring new properties, making urgent renovations, or covering temporary cash flow shortages.

- Higher Interest Rates: Bridge loans come with higher interest rates compared to conventional long-term loans. The rates can range from 8% to 12% or more, which compensates lenders for the quick turnaround and the higher risk associated with transitional credit.

- Alternative Underwriting Standards: Unlike traditional lenders, who may place heavy emphasis on the borrower’s creditworthiness and financial history, bridge loan lenders focus more on the value of the property, the borrower’s operational experience and exit strategy. This flexibility makes bridge loans accessible to a wider range of borrowers.

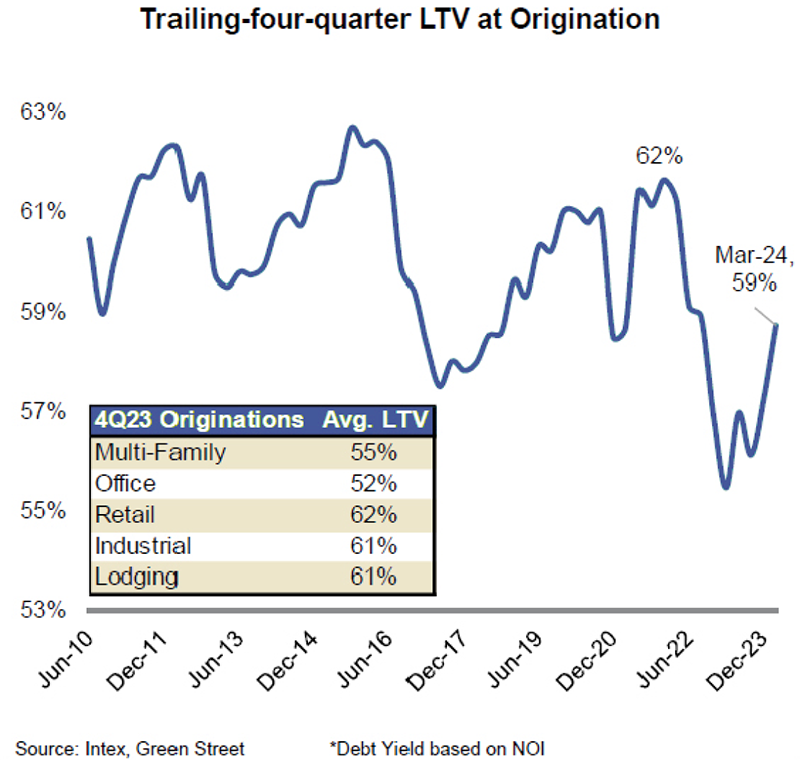

- Collateral-Based: These loans are usually secured by the property being financed. Lenders typically require a loan-to-value (LTV) ratio ranging from 65% to 80%, depending on the specifics of the property and the sponsor’s financial situation. Some lenders might accept other forms of collateral, but the property itself is the primary security. Here is a snapshot of 2023 industry LTV ratios:

- Speed of Approval and Funding: One of the most significant advantages of bridge loans is the speed at which they can be approved and funded. This rapid turnaround is crucial in competitive real estate markets where the ability to act quickly can be the difference between securing a deal and missing out.

- Customized loan structures - Private credit lenders can offer the flexibility to tailor loan structures to meet the specific needs of borrowers and their projects. This customization may include interest-only payments, flexible payment schedules, and the ability to incorporate additional capital for tenant renovations or improvements.

- Ability to finance complex transactions - Private credit lenders have experience navigating complex commercial real estate transactions, including acquisitions, repositioning, and recapitalizations. Their expertise allows them to understand the unique challenges that come with these projects and structure loans, accordingly, providing borrowers with the necessary capital to execute their business plans.

- Relationship-oriented approach - Private credit lenders often prioritize building long-term relationships with borrowers, focusing on understanding their investment strategies and goals. This approach fosters collaboration and communication throughout the loan process, ensuring that borrowers receive personalized attention and support from their lenders.

- Opportunity - Private credit investors often seek higher returns compared to traditional fixed-income investments. Investing in senior position bridge loans for commercial real estate allows investors to capture the potential upside associated with lending to real estate projects while benefiting from the security of senior lien positions and attractive risk-adjusted returns.

Some (but not all) Uses of CRE Bridge Loans

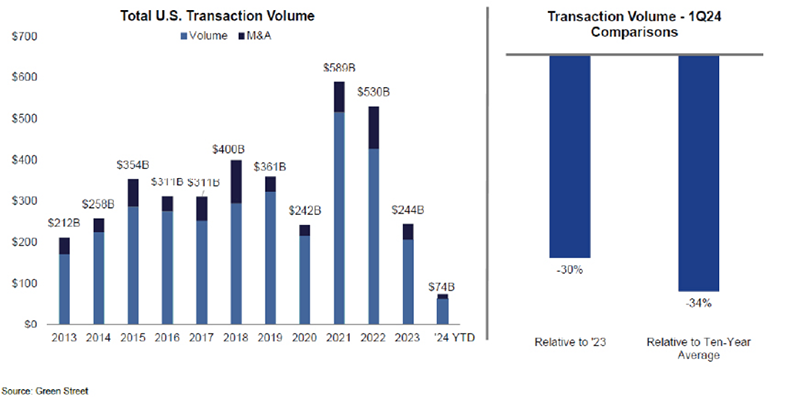

- Acquisition of Property: Investors and businesses often use bridge loans to acquire commercial properties quickly. This is particularly common in situations where the buyer needs to act swiftly to seize an investment opportunity. Bridge loans provide the necessary funds to secure the property while long-term financing is arranged. See below for acquisition volumes over the past 10 years:

- Renovation and Redevelopment: Bridge loans are frequently used to finance renovations or redevelopment projects. For example, a sponsor might use a bridge loan to purchase and refurbish an outdated office building or to convert an industrial space into a modern commercial complex. These projects often require immediate funding to get started, and bridge loans can provide the necessary capital.

- Stabilizing Cash Flow: Bridge loans can provide temporary working capital to stabilize a property’s cash flow. This is common when a property is in the lease-up phase and the owner needs funds to cover operating expenses until the property is fully leased and generating stable income. The loan ensures the property can continue to operate and attract tenants without financial strain.

- Refinancing Existing Debt: Property owners may use bridge loans to refinance existing debt that is coming due. This is particularly useful if they need more time to arrange long-term financing or to improve the property's financial performance to qualify for better terms on a permanent loan. The bridge loan acts as a temporary solution, allowing the owner to refinance under more favorable conditions.

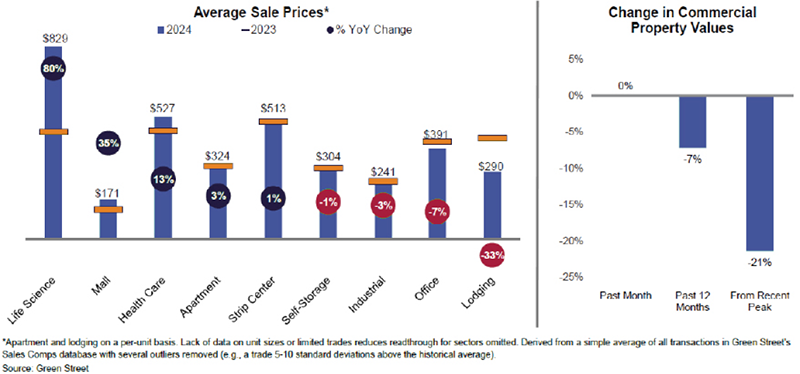

- Property Sales: Sellers can use bridge loans to facilitate the sale of a property, allowing them to move forward with another purchase without waiting for the sale to close. This is useful in complex transactions involving multiple properties or when timing is critical. The bridge loan ensures the seller can proceed with their plans without being held up by the timing of the sale. Below is a look at 2023/2024 sales across various property types:

Advantages

- Speed and Convenience: One of the primary advantages of bridge loans is their speed and convenience. Traditional loans can take weeks or even months to process, but bridge loans can often be approved and funded within a matter of days. This speed is essential in competitive markets and urgent situations.

- Flexibility: Bridge loans offer considerable flexibility compared to conventional loans. Borrowers can tailor the financing to their specific needs and circumstances. This flexibility can include customized repayment schedules, interest-only payments, or the ability to extend the loan term if necessary. This adaptability makes bridge loans suitable for a wide range of real estate projects and investment strategies.

- Leverage Property Value: Because bridge loans are primarily collateral-based, they allow borrowers to leverage the value of the property rather than relying solely on their credit history or financial statements. This makes them accessible to borrowers who might not qualify for traditional loans due to credit issues or lack of stable income.

- Facilitate Complex Transactions: Bridge loans can simplify and facilitate complex real estate transactions that require quick, temporary funding solutions. Whether it’s purchasing a property, covering renovation costs, or refinancing an existing loan, bridge loans provide the necessary liquidity to move forward with the transaction.

- Short-Term Commitment: The short-term nature of bridge loans can be advantageous for borrowers who need immediate funds but do not want to commit to long-term debt. Once the transitional period is over and permanent financing is secured, the bridge loan can be repaid without the long-term financial burden.

Considerations

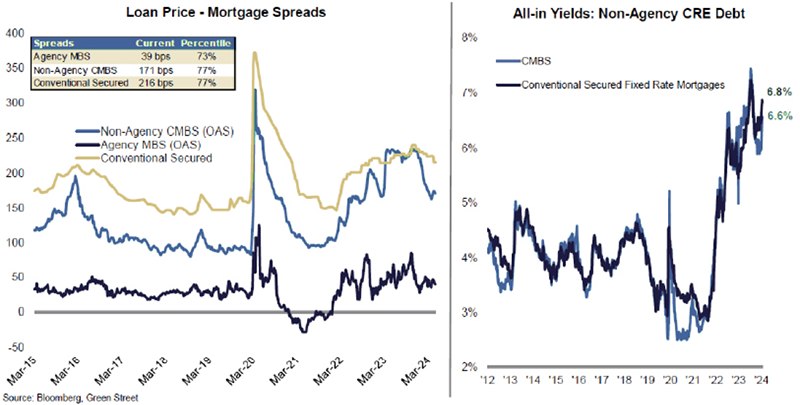

- High Costs: The convenience and speed of bridge loans come at a price. Higher interest rates and additional fees can make these loans expensive. Borrowers need to carefully consider whether the benefits of quick access to capital outweigh the higher costs associated with bridge loans. The following is a year-over-year review of loan pricing since 2012.

- Short Repayment Period: The short-term nature of bridge loans means that borrowers must have a clear and feasible exit strategy. The pressure to repay the loan within a relatively short timeframe can be challenging, particularly if the anticipated long-term financing or sale of the property is delayed.

- Market Risk: The success of a bridge loan often depends on favorable market conditions. If the real estate market experiences a downturn or if property values do not increase as expected, borrowers may find it difficult to secure long-term financing or sell the property at the anticipated price.

Conclusion

Bridge loans are important tools in the financing toolkit of real estate investors, developers, and businesses. They provide quick, flexible, and temporary funding solutions that can bridge the gap between immediate financial needs and long-term financing. The ability to secure fast capital makes bridge loans particularly valuable in competitive markets and urgent situations, such as property acquisitions, renovations, and refinancing.

However, the benefits of bridge loans come with considerations that require careful consideration and strategic planning. Sponsors must thoroughly evaluate their exit strategies, project timelines, and financial capabilities to ensure that bridge loans serve as a beneficial tool rather than a financial burden.

While commercial real estate bridge loans can provide critical support during transitional periods, they should be used judiciously and with a clear understanding of their terms and implications. By doing so, sponsors can leverage the advantages of bridge loans to successfully navigate the complexities of real estate transactions and achieve their investment goals.